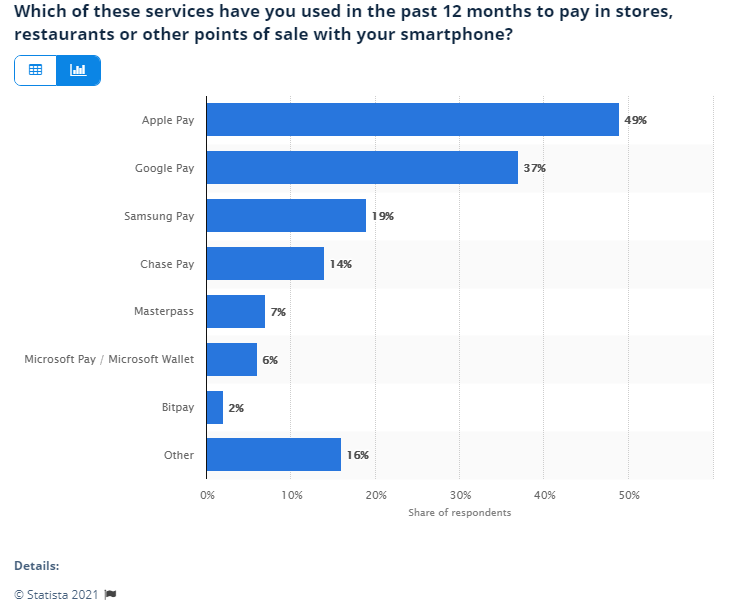

What’s the best way to attract more customers to your online business? Mobile payment options! As ecommerce has catalyzed the popularity of eWallets, more and more merchants are implementing one-step checkouts using Apple Pay.

Worldwide mobile payment revenue was valued at $1.48 trillion in 2019 and is expected to reach $12.06 trillion by 2027. Apple has about 15% of the market share. This rapid but steady uptick in the usage of mobile payments makes them the best investment for your retail business.

Read on to find out the benefits of Apple Pay for ecommerce websites and ways to integrate it as a payment method to your e-shop.

Benefits of Cashless Economy and Apple Pay’s Growing Ubiquity

If you have ever thought of people paying cashless as of show-offs, you’re way behind the times. The not-so-long-standing history of digital payments has already marked mobile as the new old, with about 1.3 billion smartphone users worldwide making at least one mobile transaction a year.

Why did this switch to a cashless economy take place? Mobile payments are praised for being quick, wireless, and effortless for the users, but there’s more to these advantages. Among many benefits of cashless economies, some of the most important ones are:

- Positive checkout experience: one-click or single-touch payments save merchants’ and customers’ time, especially during high sales seasons.

- Increased safety of financial transactions: mobile payments prevent frauds as there’s no tangible money or credit card to steal.

- Easy payment management for businesses: cashless speeds up accounting operations and saves money on storing and managing cash in banks or cash registers.

- Curbed corruption and illegal transactions: cashless economy allows to keep tabs on the paper trails and sources of funds of a particular consumer.

ApplePay perfectly fits this niche thanks to the EMV payment tokenization specification. Its advanced security features, reduced risk of card-present fraud, and convenience have made Apple Pay one of the leaders in the mobile payment market, especially in the US.

The company plans to continue beating competition and expand its influence far beyond the US. According to Apple CEO, Tim Cook, Apple has already rolled out Apple Pay to the European countries and is now adding more new users than PayPal:

Based on June quarter performance [as of 2019], Apple Pay is now adding more new users than PayPal and monthly transaction volume is growing four times as fast.

Innovative approach to payments, years of experience in card transactions, and a vast customer base shall make Apple Pay a ubiquitous payment option for online businesses in particular. So don’t be surprised to see Apple Pay integration among numerous ecommerce development services in agencies.

Expand Your Online Ecommerce Business With Apple Pay

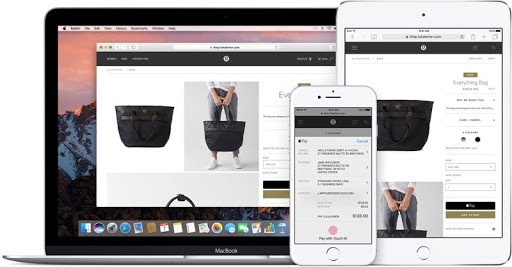

Officially released on October 20, 2014, Apple Pay is a mobile payment solution and digital wallet service that enables owners of Apple devices to make payments on the web and within apps. Apple Pay on the Web is a new technology that helps merchants manage ecommerce websites easily by adding Apple Pay as a payment option. It is supported on the iPhone, Apple Watch, iPad, and Mac, including:

- iPhone 6 and newer

- iPad Air 2 and newer models

- iPad Mini 3 and newer models

- MacBook Pro and MacBook Air

- Apple Watch-compatible devices

The Apple business payment option supports most major credit and debit cards, including American Express, Visa, Mastercard, and UnionPay. You can find below lists of all the banks supported in each country on the official Apple website.

Apple Pay provides a smooth and secure way to pay for products and services such as groceries, clothing, electronic devices, and bookings.

How Apple Pay Works on the Web

Remember we mentioned EMV payment tokenization specification? EMV is the defining factor of ApplePay in online businesses, and here’s how it works.

EMV is an improved security protocol that uses a unique code for each transaction called Device Account Number (DAN). The code is created using tokenization and is not a real card number. Once the DAN has been stored on your phone, Apple deletes your credit card number from its database.

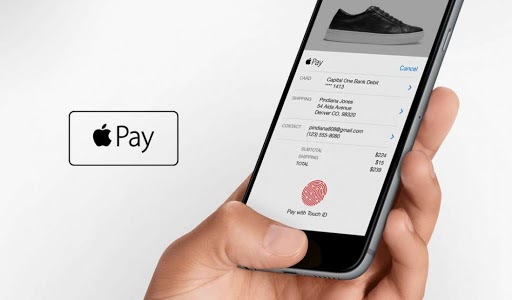

When a customer makes a payment with Apple Pay, a device verifies your identity (via a fingerprint or Face ID) and transmits a DAN over a coded connection. A merchant sends the total purchase amount, a DAN, and unique transaction code to the bank to be approved and verified according to the records saved on your phone.

This form of authentication makes it more difficult to use skimmed or copied card data. Even if hackers try to decode and steal your DAN, it’s completely useless without your fingerprint. The customer enters their card data once, and then Apple Pay stores the data for future use.

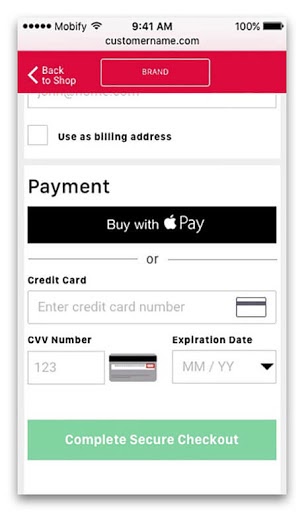

The way the Apple Pay payment option is displayed on your website depends on the browser your customers are using.

- Safari: Customers with stored Apple Pay data will see an Apple Pay button.

- Chrome and Edge: Customers with stored payment details on desktop and Android will see a “Pay with Browser” button.

The Benefits of Apple Pay for Ecommerce Websites

Apple Pay website integration isn’t just about keeping abreast of the latest technology trends. There are quite a few good reasons to add Apple Pay as a payment option for both you and your customers.

Increased Protection Against Data Theft

Apple Pay uses the latest technology for mobile services to encrypt and protect financial transactions. Each added card is assigned with a Device Account Number. That Device Account Number is then encoded and stored safely in the Secure Element, which is a dedicated chip in iPhones, iPads, and Apple Watches used to prevent unauthorized access.

Thus, your actual credit or debit card numbers are never shared by Apple with merchants minimizing the threat of data theft. Furthermore, every merchant is verified before the financial operation takes place. Every time a buyer clicks the “Buy With Apple Pay” button, Apple first checks if you are a valid merchant who is authorized to accept Apple Pay.

Simplified Checkout Experience

As mentioned above, with Apple Pay there’s no need for customers to fill in shipping, billing, or payment information. Shoppers click the “Apple Pay” button, check the purchase order and authorize it with their fingerprint or face identification. It’s the smoothest and fastest way to make a payment on an iPhone.

Moreover, you shouldn’t worry about creating confusion on the part of the buyer: shoppers are only shown the Apple Pay button if they’re using a supported Safari browser and have a device compatible with Apple Pay.

Greater Privacy

As has been mentioned above, Apple doesn’t monitor customer transactions. Moreover, the use of Device Account Numbers versus credit card data makes the transaction even more private as merchants do not see the shopper’s personal information (name, surname) and other details, such as the billing address. When you use Apple Pay, information is stored only for troubleshooting, ecommerce fraud prevention, and regulatory purposes.

Maximized Sales Potential

According to the Baymard Institute, an ecommerce website can get a 35% increase in conversion rate through a better checkout experience. Apple Pay is one of the easiest and most efficient ways to make mobile checkout experience as smooth as possible. If your payment gateway still doesn’t support this mobile wallet, it’s high time to consider switching.

Apple Pay Website Integration [Magento Merchants Only]

There are two ways in which you can integrate Apple Pay into the website as a Magento payment option. First, you can configure out-of-the-box Magento payment gateways — like Stripe or Braintree — that accept Apple Pay natively. Second, you may search and add a corresponding Magento extension after verifying it’s compatible with your store in particular.

Let’s look into these ways of Apple Pay website integration in more detail based on a Braintree/Stripe model.

Braintree payment method can be added directly from your Magento admin panel. But Apple Pay should be already configured in your Braintree account. Here are the step you should do:

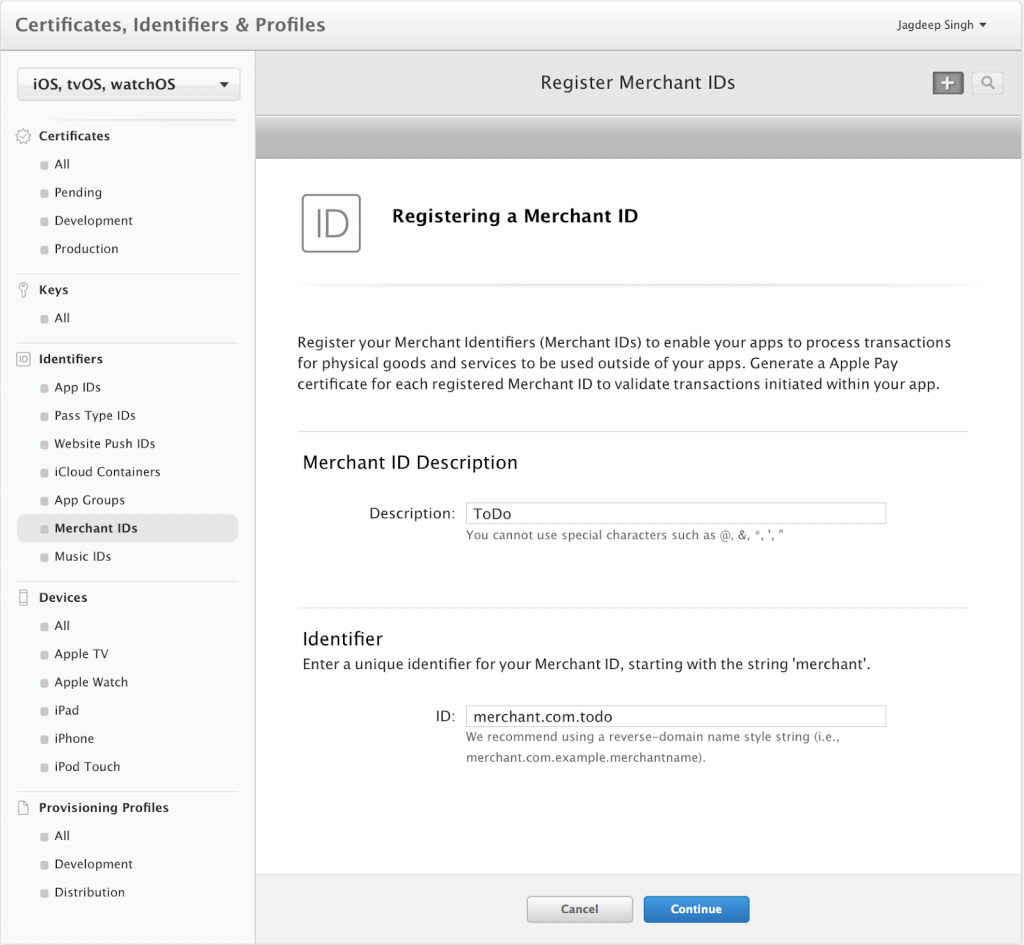

Step #1: Create an Apple Pay Merchant ID in Apple’s Developer Center. It is a unique name and number of your business that allows you to accept payments in the Apple system. Access (or create) your developer’s account and go to Certificates, IDs & Profiles → Identifiers → Merchant IDs (chosen with the Add + button). Fill in merchant description and identifier fields, continue to review the settings, and click Register.

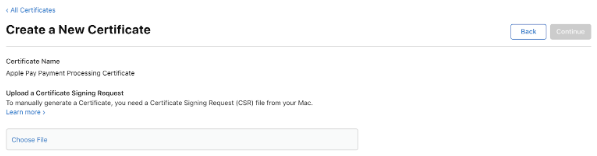

Step #2: Get a payment processing certificate that encrypts payment information. Go to your Merchant ID (use the same path described in Step #1) → Apple Pay Processing Certificate → Create certificate

Follow the on-screen instructions to request the Certificate Signing Request (CSR), save it on your computer, and upload it into a “Create New Certificate” form.

The certificate shall appear in the following screen and should be renewed every 25 months.

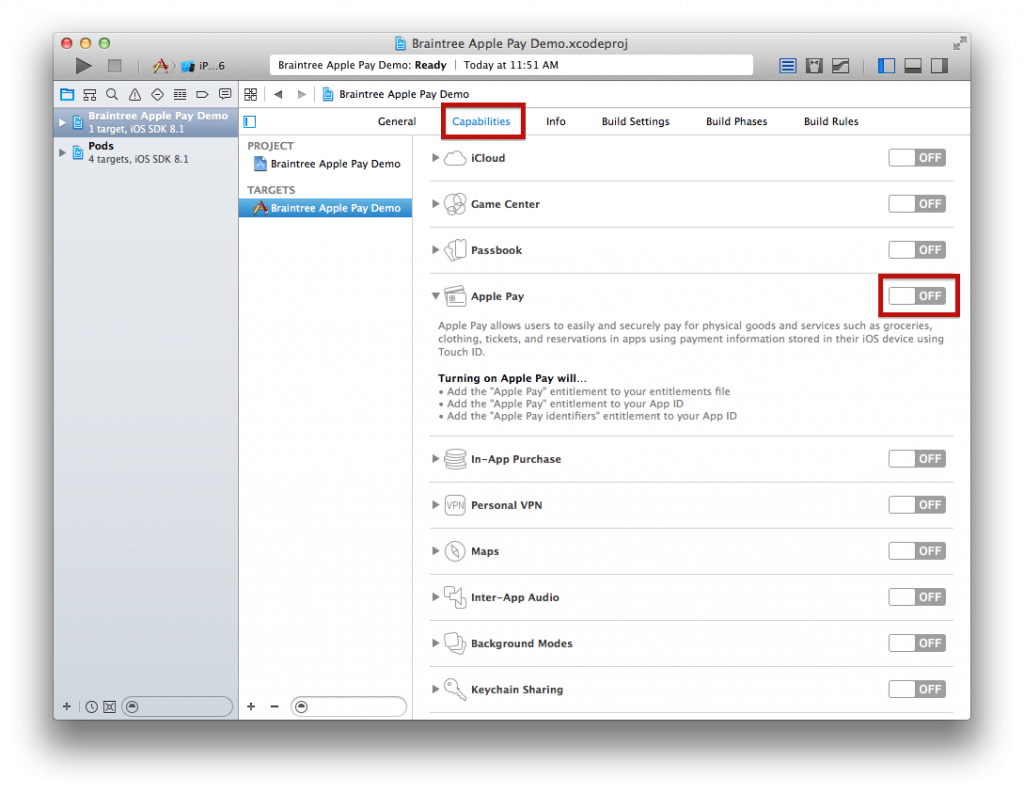

Step #3: Configure Apple Pay in your Braintree or Stripe account. For Braintree, upload an Apple Pay Certificate via the Control Panel (Processing → Payment Methods → Apple Pay → Options link → Next to Apple Merchant Certificates (iOS) → +Add). Go to Xcode and enable Apple Pay support in your Braintree Panel (Project Settings → Capabilities → Apple Pay).

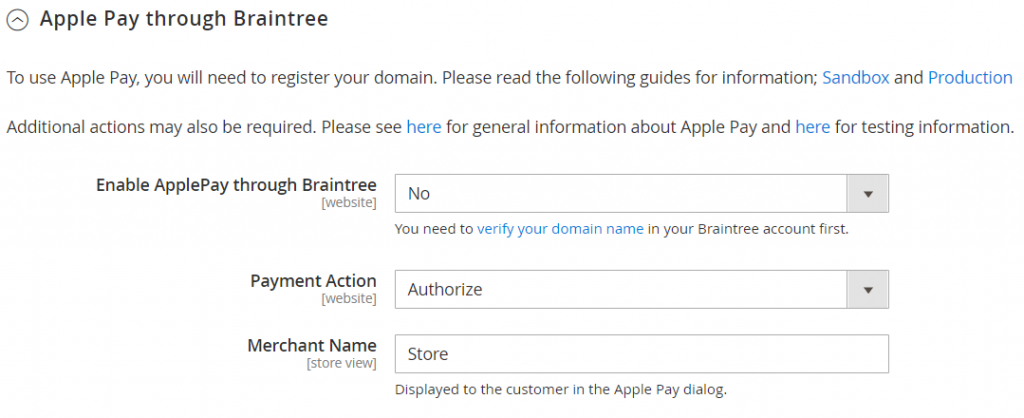

Step #4: Configure a dedicated Braintree or Stripe section in the Magento admin panel. Go to Stores → Settings → Configuration → Sales → Payment Methods → Braintree/Stripe. Add a Title (e.g., Apple Pay (Braintree) ), environment (“sandbox” for testing and “production” before going live), the credentials from your Braintree account (Merchant ID, Public Key, Private Key).

Make sure you’re logged in your Braintree account before taking the step #4.

Step #5. Enable Apple Pay through Braintree option. Fill out the rest of the fields to finish configuration, including Payment Action (“authorize” to hold off the approval of fund transfer from the customer’s account or “intent sale” to authorize and withdraw funds instantly), Payment from Applicable Countries field (set to “All Allowed Countries”), and Display on Shopping Cart (toggle “Yes”), among others.

Step #6. Finish configuration and customize your Apple Pay button.

Throughout the process of Apple Pay integration, you may still require some knowledge of programming. This particularly concerns custom solutions, whereby JavaScript code should be integrated into the core of your Magento shop. To receive your financial transaction data from Apple Pay service, you’ll have to implement a code for transaction confirmation with your payment provider to verify if the financial operation has been accepted. Such custom solutions are tailor-made for each particular store and simplify the administrative work for a merchant.

Apple Pay for Ecommerce Websites: Afterword

More and more customers are moving toward mobile shopping. If your online retail business is struggling with low mobile conversion and you want to get more orders from mobile users, make sure you’re constantly improving the mobile checkout experience.

Adding Apple Pay to your ecommerce website may be a winning move for your ecommerce shop. Don’t miss a chance to bring more sales and traffic to your Magento website.

An experienced developer can integrate Apple Pay in a matter of hours.

Turn to us at Elogic! Our Magento specialists will cater to your needs in no time.

Hire now