What’s the key to a superior checkout experience? A secure, convenient, and cost-effective payment gateway! Ecommerce payment gateways enable merchants to safely conduct financial transactions and ensure a positive customer experience by offering seamless payments.

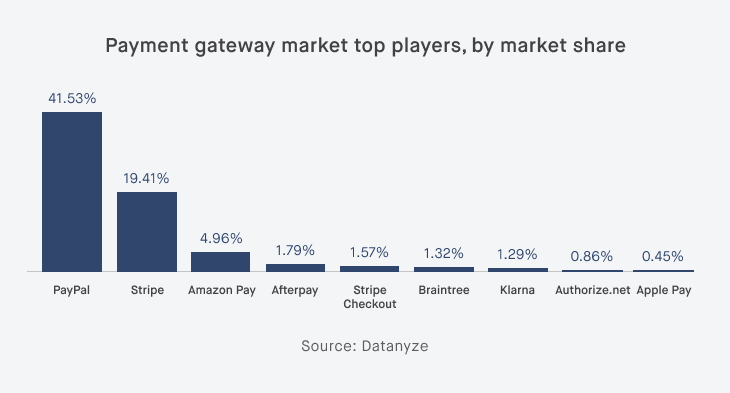

But with a variety of payment gateway providers, the choice can get tough. You obviously want to play it safe and offer your customers a reliable payment method that will cater to their preferences. And PayPal has been leading market share for years on a global scale.

But what if you’re looking for Adobe Commerce (Magento) payment gateway options beyond PayPal? Elogic is a certified Adobe Solution Partner who has helped over 200 retailers integrate secure Magento 2 payment methods, including solutions for big clients like Carbon38 and Varietal Cafe. And we can assure you there’s plenty of fish in the sea.

How a payment gateway works, what are some top Magento payment options, and how you choose one for your ecommerce website — find these and more insights in this article.

Magento Payment Methods: Definitions and Options

Many merchants use the terms payment method, payment gateway, and payment processor interchangeably, while they all mean different things. In fact, they all depend on one another as an ecommerce transaction follows the pattern payment method → payment gateway → payment processor → merchant account.

Before we go any further, let’s dig into the basic definitions of these terms and how they relate to an Adobe Commerce (Magento) store.

Payment Methods

A payment method is a way that a customer chooses to pay for a purchase. These methods can be internal or external and include cash, credit/debit card payments, eWallets, bitcoin transactions, etc. And yes, you’ve seen it right: cash transactions also apply in ecommerce although are less popular than other payment methods.

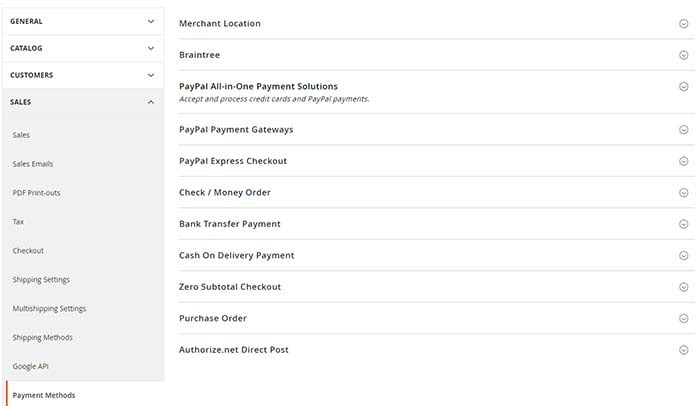

You can configure the following payment methods in Magento: check/money order, bank transfer, cash on delivery, purchase delivery, and zero subtotal checkout. For more sophisticated payment methods in Magento 2 (pay later, recurring billing, or subscription billing), you’ll need to add extensions or integrate a payment gateway which we’ll discuss later in the article.

The methods can be configured from an admin panel following the path: Admin → Stores → Configuration → Sales → Payment Methods.

Payment Gateways

An ecommerce payment gateway is a third-party service that approves credit card payments within your ecommerce software and basically bridges the transactions between your ecommerce store and a bank.

Think of it as a physical POS (point of sale) terminal in a supermarket or cafe. Just like a cash register, a payment gateway is provided and supported by a third party for your use and convenience. It accepts the credit card details of your customers, validates, and encrypts them. Thus, sensitive financial information is securely transferred from a customer to the merchant and then between the merchant and the bank.

Read more: POS Ecommerce Integration: Bringing the Bricks and Clicks Together

Magento implements three payment gateways out-of-the-box: PayPal, Braintree, and Authorize.net. A merchant can also make use of other Magento payment gateway providers, which will be discussed later in the article.

The vendor has also recently rolled out a new Adobe Payment Services tool. It is a fully integrated payment solution that keeps track of all your store payments, including settlements, refunds, and cash flow. The tool is installed as an extension but is currently available only in the US and in Canada. Check out the demo of how Adobe Payment Services work:

Payment Processors

Lastly, a payment processor is a link that connects your bank with one of your customers. It processes the query from the payment gateway, validates and executes the info about the transaction, takes the money from the customer, and then sends it into the merchant account. Once this has taken place, it informs the payment gateway if the financial transaction was successful.

In short, payment processors are financial institutions that operate in the background to provide payment processing services to online sellers and keep the process secure.

Merchant Account

A merchant account is a bank account where the funds get deposited after a successful financial transaction. A merchant account enables your retail company to accept credit and debit card payments that are submitted by a payment processor.

The key role of the payment gateway is to decline or approve each financial operation, while a merchant account is in charge of receiving payments from credit and debit cards. Merchant accounts aren’t obligatory, so you might not need one as a retailer.

How Does a Magento Payment Gateway Work?

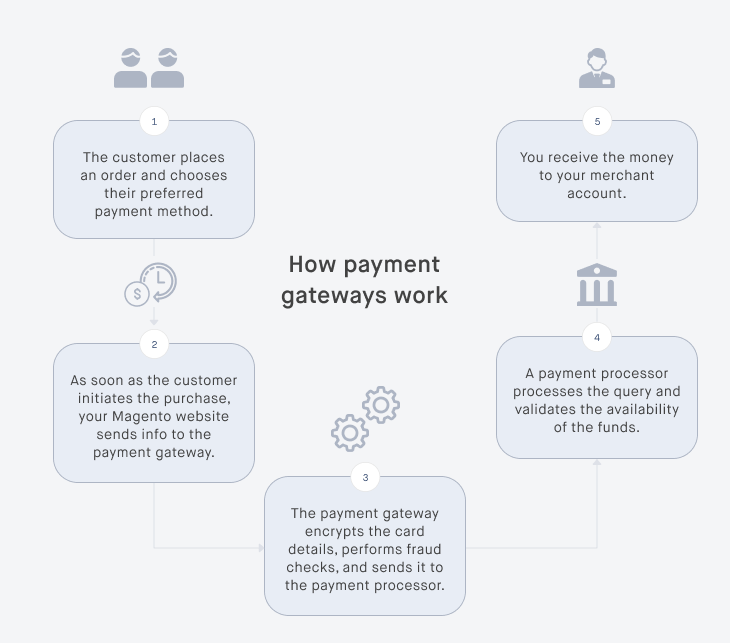

As an intermediary between a merchant and a bank, an ecommerce payment gateway preserves customer privacy and minimizes monetary hassles for a merchant. But how does it actually work? Let’s break this process down.

Even though the image above may seem like a tangle of multiple payment operations, a payment gateway (and specifically Magento payment processing) takes the following four steps:

- Step 1: A customer selects the product they want to purchase and places an order by submitting the credit card details at the checkout page. The information about the transaction is encrypted and forwarded to your payment gateway.

- Step 2: The payment gateway receives the order and authenticates the store with a Digital Certificate (a sort of your online shop ID). A customer gets the screen to choose a preferred payment method, and the payment gateway transmits the details to either the acquiring bank (in case of Magento credit card payment method) or a merchant account (in case of another chosen method).

- Step 3: The transaction is then approved or declined (depending on the costs available on the customer’s bank account) as the issuing bank or credit card (Mastercard, VISA, Maestro, American Express) authenticates the transaction.

- Step 4: The bank sends the money through the payment gateway, and the payment gateway redirects the processed payment to the merchant account. Depending on the payment gateway, it may take a few minutes or a few working days for the money to appear on a merchant account.

The beauty of it? The whole process takes 2-3 seconds max! The last step to settle the funds may take a few days, but you can be sure that with the right Magento 2 payment gateway your customer will check out in the blink of an eye.

Top 7 Payment Gateways for Adobe Commerce (Magento) Stores

Luckily for Magento merchants, the platform easily integrates with many ecommerce payment gateways via APIs. And you probably shouldn’t limit yourself to only one solution: multiple payment gateways will both cater to your customers payment preferences and give you a fail safe in case one gateway crashes.

Here’s a top Magento payment gateway list with solutions that will ensure smooth and fast ecommerce payment processing.

PayPal Pro

PayPal is one of the most popular solutions both with customers and among online store owners. It has over 218 million consumer accounts and is used by more than 17 million merchants, which makes it the biggest player on the market.

PayPal Payments Pro is a business version of a payment gateway provider. It accepts payments from American Express, Visa, Mastercard, Venmo, and PayPal Credit in 26 leading currencies. In addition to credit cards, it offers phone-based credit card payments, online invoicing, and in-person payments and is available to use in over 200 markets.

A gateway subscription is $30 per month. The fees per transaction are also quite decent: 2.90% + a fixed fee depending on the currency ($0.30 for the US or €0.35 for Europe) for domestic transactions. An additional percentage-based fee of 1.5% applies for international commercial transactions.

Magento 2 PayPal setup is available out-of-the-box. To integrate PayPal in your Magento checkout, follow these steps:

- Log into your Magento Admin panel and go to Stores

- Click Configuration → Sales → Payment methods.

- Configure your PayPal Checkout and fill in the required details (like PayPal Merchant Account, API Signature/username/password, etc.)

Find a complete guide to Magento PayPal integration on the official website of the provider.

Stripe

Available in 25 countries, Stripe delivers great payment services on a global scale and is rightfully considered the best payment gateway for Magento. This should be your go-to solution if you’re looking for Magento 2 recurring billing, setting up a marketplace, or simply accepting payments.

The main strength of Stripe is its customizability and scalability. Its developer-driven approach allows merchants (and their software engineers) to twist and turn the code and customize the gateway features based on the business size and needs. Stripe supports 100+ currencies and has such features as mobile payments, one-click checkout, and even 24/7 tech support.

Stripe is also great for subscription-based ecommerce. Umovis Lab, our Luxemburg-based client selling healthcare kits, wanted to implement the Magento subscription billing feature for their bundled products. The Magento Stripe integration streamlined their payment processes for both registered and guest users and increased customer return rates.

Stripe has no setup or monthly fees but does charge 2.9% + $0.30 per transaction.

Keep in mind: Magento 2 Stripe integration via API will require some knowledge of programming. You can try downloading a ready-made Magento payment gateway extension from a marketplace, but make sure it is compatible with your store.

Amazon Payments

Amazon Payments was launched back in 2007 and allows your customers to make all their а financial transactions on-site for a more streamlined checkout experience by using just one account. The payment solution supports 12 currencies and multiple languages.

It’s worth mentioning that Amazon Payments is one of the most trusted payment gateways in the MENA region. One of the most important requirements for our Middle East client, Saudi Coffee Roasters, was Magento 2 Amazon Pay integration in Arabic. Amazon Payments returns responses in English by default, so the Elogic team has reconfigured the language parameters in the Amazon Payment Services API and streamlined the brand’s checkout experience.

Amazon Payments charges no setup or monthly fees but has the same transaction fees as Stripe: 2.9% + $0.30 per transaction.

To activate that “Pay with Amazon” button in your Magento store, go to your admin panel → Stores → Configuration → Sales → Payment Method → Configure Amazon Pay. Follow the instructions specified on the official Amazon Pay website.

Authorize.Net

Authorize.Net has won the trust of 430,000+ merchants from small and medium-sized companies by providing them with an affordable and secure payment service. Its main advantages are the straightforward interface and ease of use, which differentiates Authorize.net from its competitors, like PayPal and Stripe.

The payment gateway provider processes payments in all shapes and sizes: credit and debit cards of Visa, MasterCard, Discover, and American Express, among others; Apple Pay and Google Pay; e-checks. It can set you up with a merchant account in case you need one and offers a virtual point-of-sale (POS) system.

Read more: Apple Pay for Ecommerce Websites: Benefits & Integration Tips

The monthly fee is $25. In an all-in-one payment option with a merchant account, Authorize.Net will charge you 2.9% + $0.30 per transaction. In a gateway-only option without a merchant account, you’ll pay only $0.10 per transaction + a $0.10 daily batch fee.

Keep in mind: The solution has long been an out-of-the-box Magento payment option; however, the Authorize.net Direct Post in Magento 2 has been recently deprecated for security reasons. Adobe recommends that you disable it in the Magento configuration and integrate it as a Magento Marketplace extension.

Braintree

Another payment solution powered by PayPal, Braintree, is suitable for businesses of all sizes, from small shops to large enterprises. It is a full-stack ecommerce payment platform that operates in 44 countries and features 130+ currencies.

Braintree is best known for its smooth checkout experience and ease of use, which provides a high level of safety and encourages repeat orders. This simplicity is the exact reason why big businesses like Airbnb and LivingSocial use this payment gateway provider.

Just like its parent company, Braintree accepts major credit cards, eWallets, and local payment methods. But it offers more extra features, like recurring billing, data encryption and fraud prevention tools. Braintree is also a great option for marketplaces. It even has a separate solution called Braintree Marketplace that scales along with your business and can be customized with the right software development team (like Elogic!).

The pricing is similar to that of PayPal: 2.9% of a flat-rate fee + $0.30 per transaction. No monthly subscription fee is charged.

Braintree can be configured directly in the admin panel of a Magento store. For a full description of an integration method, see Adobe Commerce documentation.

2Checkout

2Checkout is one of the greatest payment gateway providers for international retailers. It supports 87 currencies and 15 languages and accepts major payment methods like credit cards, debit cards, and PayPal.

There are three customizable checkout options to choose from, and the service integrates with 100+ shopping carts. The system can also automatically bill customers a monthly subscription, compile payment history reports, and sell both physical and digital products.

2Checkout has no setup or monthly fees. However, its fees per transaction are a bit higher than those of PayPal or Stripe: 3.5% + $0.35 per transaction.

Magento 2Checkout integration is implemented via API. You can download a ready-made connector from GitHub and upload it to your store instance (see the 2Checkout website for more info). In case integration seems too complicated, hire a Magento developer to do all the work for you.

Dwolla

An ecommerce payment platform built for ACH (Automated Clearing House) transfers, Dwolla is a scalable payment tool that operates with all US-based banks. As an open-source payment gateway, Dwolla allows developers to seamlessly integrate bank transfers into native tools using its flexible ACH API.

Seamless API integration allows merchants to oversee financial activity, validate bank details, search transaction information, and manage payments within the dashboard in a way that truly yields results. These functionalities and scalable infrastructure, among other factors, make it a perfect fit for B2B businesses and marketplaces.

Read more: The Best B2B Ecommerce Platform: How to Choose the Right Solution for Manufacturers And Wholesalers

Dwolla offers three pricing packages for different business sizes: Pay-As-You-Go at no monthly cost for startups; Scale for $2,000 for mid-size and large businesses; and Custom for a negotiable price depending on a merchant’s needs. Besides, an extra 0.5% may apply per transaction (min. 5¢, max. $5).

Integrating Dwolla with a Magento store may not be easy for non-techy merchants since the process requires quite a bit of coding. Yet, with partners like Elogic, you may see your customers paying via Dwolla in a matter of days!

How to Add a Magento Payment Gateway Integration

Once you have decided which payment gateway you will use for your online store, it’s time to integrate it. Here’s a quick guide to ecommerce payment gateway integration with a few high-level steps you need to take:

- Install a Magento payment gateway plugin of your choice. Then, from your Magento Admin panel, go to System → Web Setup Wizard → Module Manager. Find your payment module and enable it.

- As soon as your extension has been installed, you’ll see it in your Magento Admin panel on the left. Click on it, go to Settings, and configure it in the Payment methods section.

- Go to the website of your payment gateway (or a Merchant Account); find and copy the API keys from there into your Magento system; enable Sandbox Mode; and fill in other requested data.

- Once everything is settled, you should see more payment methods on your checkout page. If a customer places an order, you’ll see the transaction in your Magento Admin panel and on your Merchant Account.

All the aforementioned steps may vary from one payment gateway to another. You may surely try integrating it yourself; but if only the word integration scares you, turn to a professional Magento payment gateway development agency.

Elogic has vast expertise integrating third-party systems in e-stores across multiple industries. Build your own Magento custom payment module or integrate an existing one with us and start receiving payments ASAP.

Things to Consider When Choosing a Magento 2 Payment Gateway

The main purpose of an ecommerce payment gateway is to make financial transactions fast and secure. Before choosing your Magento ecommerce payment gateway, ask yourself the following questions:

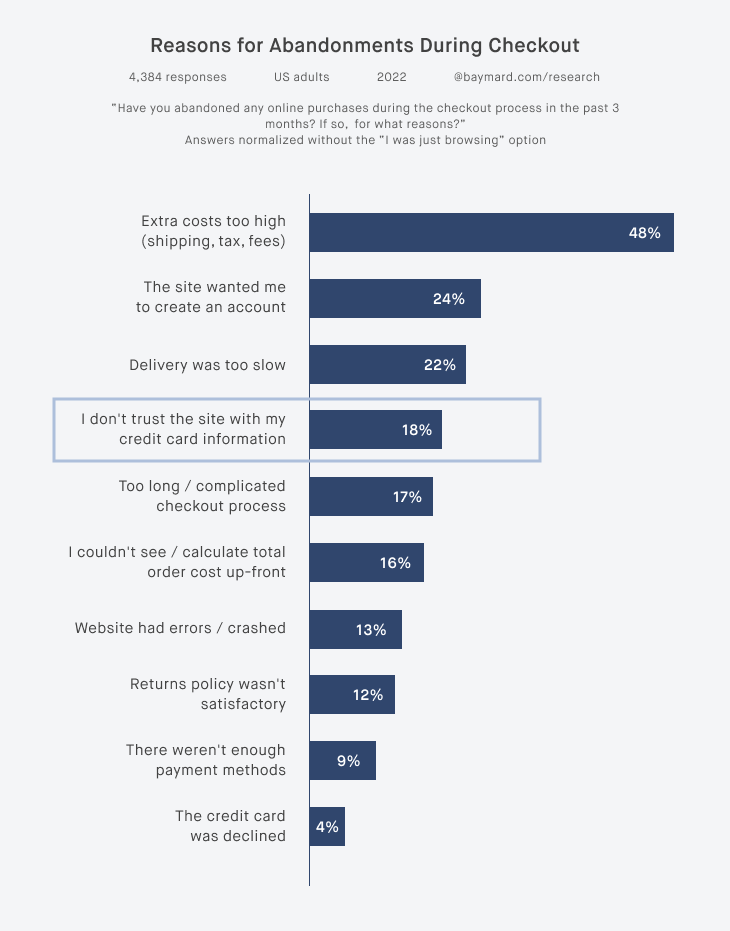

- How secure is this payment gateway? If there’s even a slight chance a customer’s credit card details is compromised, he/she will abandon the cart and stop shopping with you. Security should be the first thing you inquire about a payment gateway.

- Does this gateway support various payment methods? Offering your customers different options for Magento credit card processing, you’ll see your sales up and rising. Make sure your gateway accepts different types of payments: credit/debit cards and mobile payments are the least you can do.

- Is it easy to set up and use? You want your customer’s money straight on your account, and a non-intuitive, complicated interface of a gateway will only add extra headaches to the financial process. Integrate only those payment gateways that are easy to use.

- What is your budget? It is normal for ecommerce gateway providers to charge extra for their services, but check that the fees don’t go over the top.

- Does it align with your business objectives? You’ll need to put in place your business requirements for a payment gateway, considering your business type (B2B, B2C, DTC, etc.), short- and long-term goals (e.g. international expansion), your customers’ geography, etc. Write it out before choosing the right payment gateway.

An Optimal Payment Gateway Is the One That Serves You Best

Choosing the most suitable ecommerce payment gateway is crucial to the success of your retail business. You can improve your customer experience, boost your brand authority, and increase revenue.

All you should do is consider the pros and cons of each ecommerce payment gateway in line with your business requirements and customer preferences.

Contact us at Elogic and get expert consulting on Magento payment gateway integration services

Get in touchFAQs

What is the Magento payment methods list?

Some of the payment methods available out-of-the-box in Magento include: check/money order, bank transfer, cash on delivery, payment on account, and zero subtotal checkout. A merchant can also configure PayPal, Braintree, and Adobe Payment Services without any extension or plugin installation.

How to integrate payment gateway in Magento?

Magento 2 payment gateway integration can be done in three steps:

- Set up an account with your payment provider and install its extension from the Magento Admin panel.

- Configure the new payment method, copy API keys from the payment provider into the Magento Admin panel, fill in other requested data.

- Customize payment methods available to a user at checkout.

These steps are high-level and might require the attention of a professional Magento engineer to integrate a payment method in a neat, secure way.

How to set up Authorize.net in Magento?

Authorise.net is available out-of-the-box in Adobe Commerce (Magento) and can be configured following the path Admin → Stores → Configuration → Sales → Payment Methods.

- Set up an account with your payment provider and install its extension from the Magento Admin panel.

- Configure the new payment method, copy API keys from the payment provider into the Magento Admin panel, and fill in other requested data.

- Customize payment methods available to a user at checkout.

These steps are high-level and might require the attention of a professional Magento engineer to integrate a payment method in a neat, secure way.