Remember the time when bitcoin was a joke?

In the 2010s, when the newfangled cryptocurrency was only coded into existence, Laszlo Hanyecz spent 10,000 bitcoins buying a pizza. Little did he know that in 2022, cryptocurrency ecommerce capabilities would make his order cost $80 million.

Nowadays, disruptive ecommerce leaders, like Walmart and Amazon, are increasingly embracing cryptocurrency as a payment method. The reasons are obvious: backed by blockchain technology, crypto presents many potential benefits to ecommerce merchants, like security, trust, and transparency. Still, small to mid-sized businesses seem to be wary of hopping on this trend.

Which brings us to the question: why cryptocurrency can’t be ignored and how can online retailers prepare for the crypto ecommerce revolution? In this article, we’ll provide the cryptocurrency definition, explain the advantages and disadvantages of cryptocurrency for merchants, and outline the first steps to start accepting it on your ecommerce website.

What Is Cryptocurrency?

Cryptocurrency is a digital form of currency (token) that’s secured and encrypted using blockchain technology. It is not backed by any bank, government, or other assets like traditional currencies. Instead, it’s generated by mining using computer power to solve complex mathematical problems that produce coins.

Because generating a single coin requires power and resources, the value of crypto lies in its restricted supply and increasing demand.

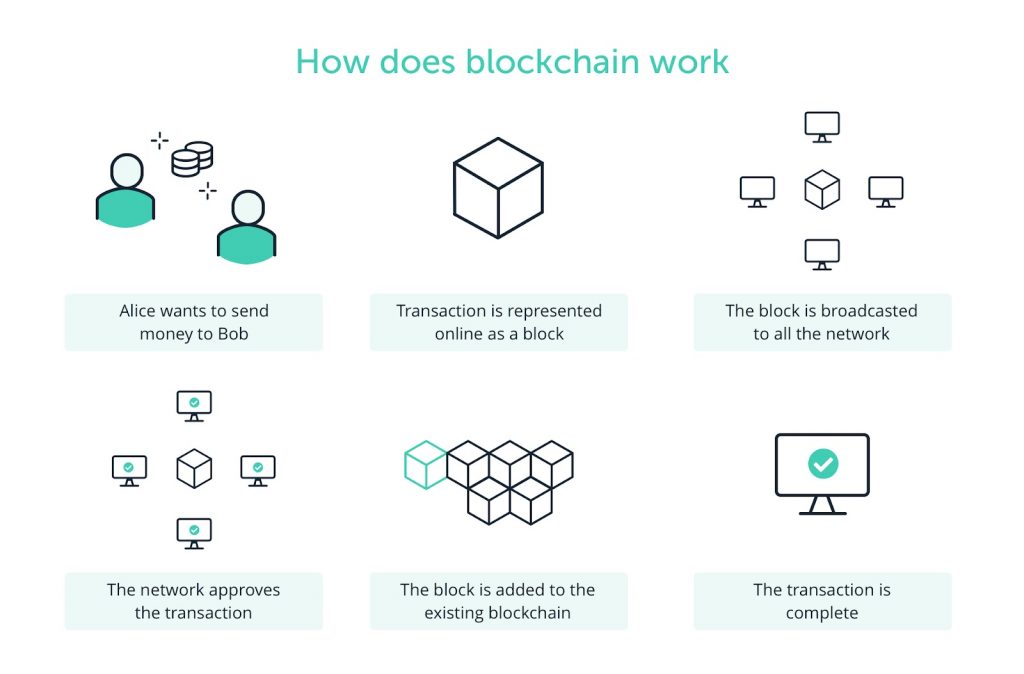

All cryptocurrency transactions rely on distributed ledger technology, or DLT. The ledger acts as a decentralized database that records all transactions (“blocks”) within a particular currency and stores them on multiple computers around the world. Blocks of transactions are securely linked into a chain that can’t be edited or modified later (hence, blockchain).

There are currently more than 16,000 cryptocurrencies, the biggest ones being Bitcoin, Ether, and XRP (Ripple). They all hold different values and can be acquired from a traditional broker or on a dedicated cryptocurrency exchange.

How to Use Cryptocurrency in Ecommerce?

Even though crypto remains an extremely volatile investment, Gartner predicts that by 2024, at least 20% of large enterprises will use digital currencies for crypto ecommerce payments, stored value, or collateral.

In fact, quite a few ecommerce retailers have started accepting cryptocurrency now as a form of payment by integrating digital wallets into the checkout page. Here are a few ecommerce companies accepting cryptocurrency in their operations:

- Microsoft: in 2014, the tech giant was one of the first to accept Bitcoin payments to buy Windows licenses to games, movies, and apps.

- Starbucks: the famous coffee maker struck a deal with a third party payment app Bakkt to allow its reward members to convert cryptocurrency into cash on their Starbucks cards.

- Lush: since 2017, the handmade cosmetics brand allows Bitcoin payments for online orders through a partnership with Bitpay.com

- REEDS Jewelers: a high-end iconic jeweler accepts bitcoin payment online in all its 65+ stores across the United States.

- airBaltic: the airlines accept a wide range of cryptocurrencies, such as Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Dogecoin (DOGE) and 4 USD-pegged stablecoins (GUSD, USDC, PAX, and BUSD) as a payment for tickets sold on its website.

- eGifter: the gift card marketplace accepts bitcoin payments via BitPay since 2014.

Most ecommerce platforms are now hardwired to accept cryptocurrencies via third-party system integrations. These include Shopify, BigCommerce, Magento, WooCommerce, and PrestaShop, to mention a few.

Read more: Ecommerce Future Trends in 2022 You Should Definitely Watch

Benefits of Cryptocurrency in eCommerce

Large retailers might have benefited a lot from cryptocurrencies, but what if this strategy doesn’t work for you?

Let’s dig into the advantages of cryptocurrency in ecommerce.

Lower Transaction Fees

Crypto promises to reduce transaction fees, which will make ecommerce businesses more profitable for merchants. Some of the best payment gateways, like PayPal or Stripe, will charge 2.9% + $0.30 for handling online credit card transactions. Meanwhile, the fee for cryptocurrency ecommerce transactions might be as low as 1% or non-existing at all. They are also not subject to third-party chargebacks.

Reduced Risk of Frauds

Allowing crypto payments might be the best ecommerce fraud prevention practice. The blockchain technology clamps down on scams and misuse of sensitive information. Because all data is encrypted, online criminals won’t be able to move and spend funds off of blockchain networks.

Besides, crypto transactions are pseudonymous. A sender and a receiver can only be identified by the address to which they receive a bitcoin. The address is further encrypted in a block, which provides an extra layer of security to the user’s sensitive data.

Broader Market Reach

No bank intermediaries = no attachment to a single currency. Bitcoin and its brethren are universal currencies that open access to trade with a large pool of customers worldwide.

The benefit is twofold. First, it becomes easier to start selling products internationally, and you’ll witness more user traffic to your website. And second, customers paying with crypto represent a more tech-savvy, cutting-edge clientele who value financial transparency and are willing to spend twice more than credit card users.

Faster Transactions

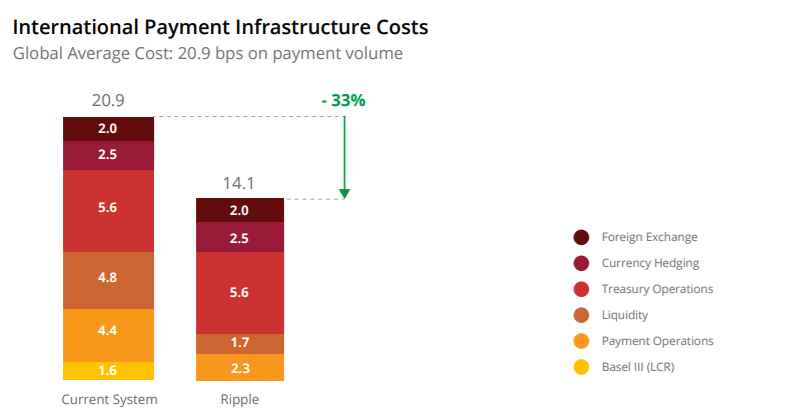

Cryptocurrency ecommerce transactions happen here and now. There’s no need to wait for the bank opening hours or another centralized authority to approve the payment. In fact, most banks admit the potential of blockchain to automate the transaction verification process and reduce banks’ infrastructural costs.

This advantage brings faster settlement times. The cryptocurrency market is available to trade 24/7, and the transactions take place in real time. Thus, companies can streamline their business cash flow and implement more aggressive expansion plans.

How to Accept Cryptocurrency Payments on Your eCommerce Website

The good news for those who have eventually decided to accept cryptocurrencies on a website is: it doesn’t take much to set it as a payment method. All in all, you’ll have two options to consider when accepting crypto for ecommerce.

Payments Through a Digital Wallet

This option allows merchants to accept cryptocurrency directly without any intermediaries and, hence, without any transaction fees. Follow these key steps to accept payments through a crypto wallet:

Step #1: Set up a digital wallet, which can be stored on hardware or online. Chances are you’ll accept different types of crypto, so it’s best to go for a multi-cryptocurrency wallet (like Coinbase Wallet or Ledger) that holds several types of cryptocurrencies.

Step #2: Get your payment receiving code. Generate your receiving bitcoin address and/or a scannable QR code and add a corresponding payment button on your website. for each sale and indicate the amount of money your customers should send.

Step #3: Invoice your customers. Notify the users on how to proceed with payments via email or your preferred messenger. It might be slightly inconvenient for you as a merchant but should work for small ecommerce stores.

Watch your private keys! If you lose your private keys to a digital wallet, you risk losing access to all your cryptocurrencies.

Also, mind that all crypto transactions are irreversible. So if you provide the wrong address or wallet QR code, the payment won’t be refunded.

Payments Through a Third-Party Processor

If building an ecommerce and cryptocurrency payment workflow is too time-consuming, you should go for third-party payment gateways. Such third-party services as BitPay, Coinbase, or NOWPayments will handle crypto transactions for you.

This option has two great advantages:

- Apart from handling the transactions on your behalf, third-party processors can automatically convert your bitcoin into cash. This way, you might cushion yourself from the possible currency volatility on the market.

- Most ecommerce platforms offer ready-made integrations with cryptocurrency processors. For instance, Shopify and BigCommerce merchants can activate a crypto payment method directly from their admin panel. Magento merchants may also install a corresponding plugin or connect to the required processor via API.

While choosing a crypto payment processor, pay strong attention to the payout frequency and supported currencies. Expect to pay up to 1% in transaction fees, as well.

Read This Before Accepting Crypto for Ecommerce

Accepting crypto payments doesn’t end with mere integration in your ecommerce platform. You should make it a part of your global business strategy, embracing the advantages crypto brings as well as the possible risks.

Here are key things merchants should do before using cryptocurrency for ecommerce purchases:

- Analyze your audience and their needs.

The survey indicates that 45% of crypto owners are millennials, born between 1980 and 1996, with a college or post-college degree earning over $50,000 per year. So unless your ecommerce business caters to the young, tech-savvy audience, it doesn’t make much sense to introduce crypto as a payment method.

- Communicate the newly introduced payment method.

Stay open in your communication strategy. Introducing crypto on your ecommerce website might actually spur awareness about your brand and even position you as a disruptive leader for the future. You can announce your strategy on your website, via emails or mass media, or on social media networks (like luxury goods brands did, for instance).

- Think about the taxes.

Even though crypto isn’t strictly regulated worldwide, some countries have already introduced ways of taxation for the payments. For example, the US International Revenue Services (IRS) considers cryptocurrencies as capital assets which attract capital gains tax. Inquire about the tax implications in your region and comply with them.

- Running a luxury brand? Integrate cryptocurrency without a second thought!

The global luxury market is forecasted to reach US$1.5 trillion by 2025, with millennials representing 50% of the total market. This target audience currently drives 85% of global luxury sales growth and will make loyal customers to your brand.

Wrap-Up: What the Future Holds for Ecommerce and Cryptocurrency

Accepting cryptocurrency in ecommerce isn’t just a trend. Despite many skeptical views, crypto might be a huge capitalization opportunity for retailers to take their business to the next level and engage with new clients and vendors.

Cryptocurrency integration is relatively easy. If implemented as a part of the global business strategy, it will bring more security, transparency, and trust to the website payment methods.

Plus, you get an additional advantage of low transaction fees.

If you’re tempted to try cryptocurrency for ecommerce but don’t know where to start, we’re here for you. Request Elogic ecommerce web development services and transform your store into a disruptive leader in the retail sector.

Develop a cutting-edge website and beat your competition by accepting cryptopayments

Build my ecommerce store now